Dr. Anthony Bartels

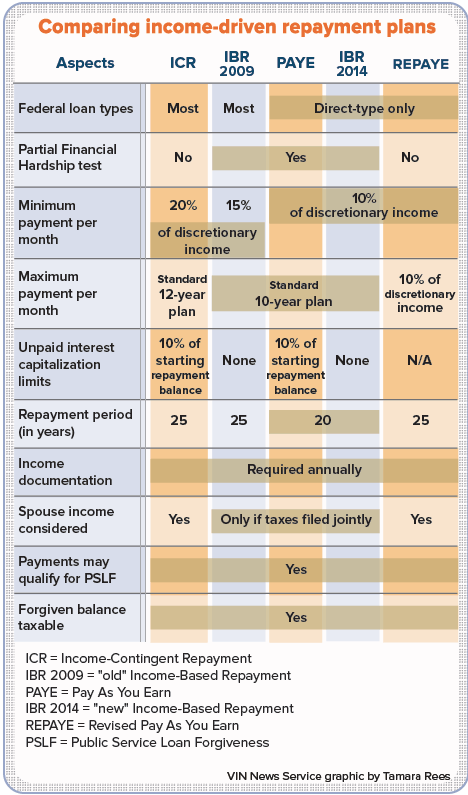

This brings the number of income-driven repayment options to five. From oldest to newest, they are: Income-Contingent Repayment (ICR); Income-Based Repayment (IBR), for which there is a new and old version; Pay As You Earn (PAYE); and now, REPAYE. Got it?

If not, don’t worry. We and others are keeping track for you, including student loan expert Heather Jarvis and the Department of Education.

Income-driven repayment plans are a necessity for those with relatively high debt-to-income ratios. These days, that includes many veterinary school graduates, who borrow their full cost of attendance and end up with debt-to-income ratios that commonly exceed 2-to-1. Among the newest graduates, debt-to-income ratios of 3-to-1 and 4-to-1 are not unheard of.

The goal of income-driven repayment is to set the minimum monthly student loan payment to a manageable percentage of the borrower’s discretionary income. It is 20 percent under ICR, 15 percent under old IBR, and 10 percent under PAYE, new IBR and REPAYE. For calculating loan payments, the Department of Education considers discretionary income to be equal to your taxable income minus 150 percent of poverty guidelines for your family size and state of residence.

Tying loan payment size to income provides borrowers, particularly new graduates, significant financial flexibility. However, it comes with some interesting side effects because payments often are not great enough to cover the monthly interest accrual. This is where REPAYE attempts to shine over other income-driven plans. More on that below.

Note that none of the other options is being replaced or phased out. To paraphrase a line from the great health-care debate, “If you like your current federal student loan repayment plan, you can keep it.” All the same, switching is at least worth considering.

Figuring out whether it’s worthwhile is not an easy exercise, however, notwithstanding the title of the Department of Education blog post, “Your Federal Student Loans Just Got Easier to REPAYE.” While that’s a clever spin on the name, the process of deciding whether to use REPAYE and applying for it can make your head spin. That’s because any benefits of switching are highly dependent upon borrowers’ specific circumstances.

Let's review some considerations.

Only Direct Loans qualify, regardless of disbursement date

This is different from IBR and PAYE. IBR allows borrowers of both Federal Family Education Loans (FFEL) and Direct Loans to make repayments under IBR as long as they demonstrate need. PAYE repayment can be made only on Direct Loans received after a specific time period by those with a demonstrated financial need.

This is different from IBR and PAYE. IBR allows borrowers of both Federal Family Education Loans (FFEL) and Direct Loans to make repayments under IBR as long as they demonstrate need. PAYE repayment can be made only on Direct Loans received after a specific time period by those with a demonstrated financial need.

If you have federal loans other than Direct Loans — FFEL, Health Professions Service Loans, Perkins — that you'd like to repay under REPAYE, you may consolidate into a federal Direct Consolidation Loan. However, if you have been repaying under IBR or PAYE or working toward Public Service Loan Forgiveness (PSLF), know that consolidating will reset the forgiveness clock. (Under these programs, borrowers make payments for a specified period of time, after which any remaining balance is forgiven. The forgiven amount is taxable except in PSLF.)

Borrowers need not demonstrate financial need

To use IBR or PAYE, you must demonstrate what the government terms a Partial Financial Hardship (PFH). You are deemed to have a PFH when your minimum monthly payment under IBR or PAYE is less than it would be per month under a standard 10-year payment plan. REPAYE does not require demonstrating financial need. Under REPAYE, monthly payments are 10 percent of your discretionary income, period.

To quickly illustrate how the 10 percent figure could benefit some borrowers: For those using old IBR, monthly payments are 15 percent of discretionary income. A monthly payment of $900 under old IBR would drop to $600 under REPAYE.

At the same time, REPAYE establishes no maximum monthly payment. By contrast, under IBR and PAYE, the PFH test sets a maximum monthly payment equal to the monthly payment in a standard 10-year repayment plan. In other words, you’d never have to pay more in a month than you would have paid if you were on a standard 10-year plan.

With REPAYE, the minimum monthly loan payment will be 10 percent of your discretionary income in all cases. As your income rises, you could end up paying more each month than you would have under a standard 10-year repayment plan. But let’s face it, making too much money usually is a good problem to have. And if for some reason you find that the REPAYE payment is too high to handle comfortably, you can switch to a standard 10-year plan.

The lack of a financial means test under REPAYE also means you don’t have to worry about interest capitalization that occurs under plans that stipulate a PFH. This is a win-win, in my opinion. However …

Switching to REPAYE from IBR or PAYE will cause unpaid interest to capitalize

If you use IBR or PAYE and your monthly payments are not covering the interest that accrues each month, you will have what loan servicers call an unpaid-interest or accumulated-interest balance.

Under both of these older plans, unpaid interest does not accrue additional interest while you remain in the plan and continue to demonstrate a PFH.

However, when you leave an income-driven repayment plan, all unpaid interest gets capitalized, even if you’re switching to another income-driven plan. Now that unpaid interest will accrue interest because it becomes part of your principal balance.

So if you switch to REPAYE, any unpaid interest will capitalize. The amount of unpaid interest will be rolled into your principal balance, meaning that you will be paying interest on interest.

All the same, depending on income, family size and unpaid interest balance, switching to REPAYE still could be a great idea for some. For one thing ...

REPAYE provides a generous interest benefit

Easily the best feature of REPAYE: If your minimum monthly payments do not cover the interest that accrues each month, you are charged only 50 percent of the unpaid interest. That means your unpaid interest balance will grow half as fast, potentially greatly reducing your repayment costs and total amount forgiven. But if that alone sounds like a good reason to switch, bear in mind …

REPAYE adds more complications for married borrowers

Under IBR and PAYE, your spouse’s income is considered only if you file a joint tax return. This has been a significant consideration for borrowers in figuring out the filing status that makes the most financial sense for them in terms of tax liability and loan payment. Under REPAYE, you and your spouse's income are combined regardless of tax filing status.

There are certain exceptions for those who are separated from their spouses and lack access to the spouse's income information, but in most circumstances, you must include your spouse's income in your REPAYE monthly calculation.

For double-vet, double-debt households, REPAYE likely will be a beneficial option, again, depending on individual circumstances. For couples who file separately now to keep an IBR or PAYE payment low, REPAYE may not be that great of an option (again, depending on circumstances). And for households in which only one spouse holds the debt or one spouse makes the majority of the income, other specifics will determine whether REPAYE is beneficial.

Run the numbers

The variables are so complicated and interdependent that I’m uncomfortable offering scenarios under which it would be beneficial or detrimental to use REPAYE. Members of the Veterinary Information Network, an online community for the profession, may post their specific circumstances for assistance and advice.

Readers who don’t have access to VIN may run their numbers on a repayment estimator provided by the Department of Education or use the VIN Foundation student loan repayment simulator. The VIN Foundation tool doesn’t include REPAYE yet but it gives the user more flexibility to change income and family-size scenarios than the Department of Education estimator.

As we enter tax season, this is an excellent time to discuss REPAYE with your tax accountant or certified financial planner, if you use one. If your accountant or financial adviser isn’t familiar with REPAYE and the other student loan repayment options, find one who is, or encourage yours to bone up.

Be aware that the pros and cons of switching may change as your circumstances change. So keep in mind that if you get married or divorced, start a family, have an appreciable rise or fall in income, or undergo any other significant change in situation, you should re-evaluate your student loan repayment plan.

REPAYE sets a maximum repayment period of 25 years for those with graduate-school loans

That includes veterinarians.

Any unpaid balance at the end of 25 years, after the borrower makes 300 monthly payments, are forgiven and treated as taxable income under REPAYE.

Here’s a plus: Monthly payments made on Direct Loans under other income-driven plans will count toward the total repayment period under REPAYE. So if you've been paying for five years on Direct loans using IBR and you switch to REPAYE, you'll have no more than 20 years of monthly payments remaining. Make sure, however, to consider the capitalization of any unpaid interest, as discussed above.

Bottom line: It's great that we have yet another option to consider when repaying federal student loans. And in general, if your minimum monthly student loan payment results in an unpaid interest balance, you really need to take a look at REPAYE.

However, the addition of one more repayment plan means we have even more variables to consider. Things were slightly more straightforward before REPAYE. More often than not, you’d qualify for only one income-driven repayment plan, so the choice was more limited: go with income-driven repayment or not? Now there are so many variables on top of other variables, the evaluation becomes an epic mathematical exercise that can induce analysis paralysis.

But if you don’t check it out, you might end up leaving tens of thousands of dollars on the table. So take a deep breath and dive in.

About the author: Tony Bartels, DVM, MBA, is a 2012 Colorado State University graduate and employee of the Veterinary Information Network. His professional interests include small animal and exotic medicine, educating colleagues on veterinary student loans and repayment strategies, and advocating for internship quality control. When he’s not staring holes into his family’s student-loan statements, he enjoys spending time with his wife Audra, a small animal internal medicine specialist practicing in Denver. Other family members include a back-alley street mutt named Herbie and a tortoise named Leo, who now occupies a rather large territory in Arizona. During his free time, Dr. Bartels enjoys stopping a few shots on the ice as a goaltender or fly fishing the Mountain West.