Dr. Anthony Bartels

It’s graduation season, and to those completing veterinary school, I say, congratulations, doctors! For those who borrowed money to pay for school, this moment of passage also means loan repayment begins soon. So, let’s talk about how to use your grace period wisely to get a jump on your loan-repayment plan.

One of the most intriguing questions I received recently on student-loan repayment is, “Why does it need to be so complicated?” I wish I knew. Unfortunately, we have the system that we have, and for those who used federal loans to finance their education, it encompasses a variety of traditional and income-driven repayment options

While I can’t do anything about the rules and structure in place for repaying loans, and I can’t do much about what the market will pay a graduating veterinarian, I can advise new veterinarians how to keep repayment as simple as possible. It boils down to three steps: Take inventory. Consolidate. Calculate your debt-to-income ratio.

Take inventory

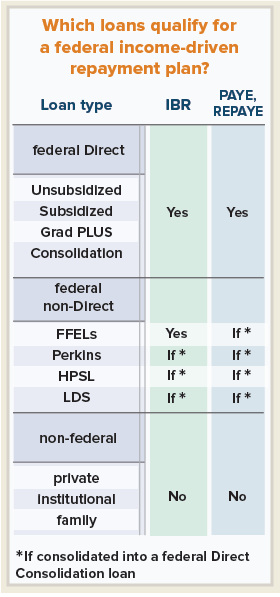

A myriad of student loans are available, some disbursed directly from the federal government (Direct Unsubsidized, Grad Plus); some federally backed but administered at the university level (Perkins, Health Professions Student Loans, Loans for Disadvantaged Students); some from schools (“institutional”); and some from private financial institutions. Some students borrow money from family or friends, as well.

You can find most of your federal student loans via the National Student Loan Data System (NSLDS). Log in using the same Federal Student Aid Identification (FSA ID) that you used to apply for the loans. NSLDS is the official record of all the Title IV loans and/or grants you received over your educational career. Graduating veterinarians will find federal Direct loans, Federal Family Education Loans (FFEL) and Perkins loans in the NSLDS.

Health Professions Student Loans (HPSL) and Loans for Disadvantaged Students (LDS) can be found through your school financial-aid accounts or via the servicer your school uses for those types of loans. You also may find those on your credit report. Run a report from all of the three major reporting agencies — Equifax, Experian and Transunion — to fully identify your loans, because not all loans are reported to every reporting agency. Fortunately, you can obtain a free credit report every year from each of the three major reporting agencies.

Institutional and private loans will not be found via the NSLDS but will appear on your credit reports, which is another good reason to obtain those free credit reports when you graduate. Family loans will not be found in either the NSLDS or credit reports, but make sure you have clearly written terms and expectations for repaying those loans.

Once all loans are accounted for, arrange them by loan type, noting disbursement dates, interest rates, unpaid interest, loan servicers, grace periods, repayment start dates, and terms of repayment.

Consolidate federal student loans

After identifying all your federal student loans (Direct, FFEL, Perkins, HPSL, LDS), initiate a federal Direct Consolidation loan. The best time to do this is during your grace period, which is six months for most loans, but can vary. Each loan comes with only one grace period. If you have used all the grace period on any given loan — such as during a break in your schooling — repayment must begin immediately after graduation on that loan.

Consolidation is helpful in several ways. You reduce a multitude of loans with various repayment terms, and sometimes serviced by various companies, into a single loan. The Direct Consolidation loan can be managed by a single loan servicer of your choice and repaid using a single repayment plan. This is particularly important if you have a mixture of federal Direct and non-Direct loans that you’d like to qualify for an income-driven repayment plan or Public Service Loan Forgiveness. Most of those plans are available only for federal Direct loans. That includes federal Direct Consolidation loans.

By consolidating during the grace period, you also reduce the amount of interest that accrues during the grace period, thereby lowering your starting repayment balance. Your starting repayment balance represents the principal on which you will be charged interest going forward. The lower that starting repayment balance, the less interest you will be charged during repayment.

Direct Loan consolidation also allows you to choose your loan servicer. Who cares about that? You should care, especially now that we know Navient believes there is “no expectation that the servicer will act in the interest of the consumer.”

Not all federal loan servicers are created equal, and some have proven to be particularly terrible at administering income-driven repayment plans. A loan servicer’s failure to provide knowledgeable support can cost you time, emotional distress and thousands of dollars over the course of repayment. Choose your loan servicer wisely. From experience and observation, I believe that loan servicers fall along a spectrum of least terrible to most terrible. They all make mistakes routinely. The least terrible ones are willing to admit it and help you move on. The most terrible refuse to admit it, are verbally abusive and insist that you, the borrower, are always doing something wrong. I’ve found Navient to be the most terrible, followed by Nelnet. FedLoan Servicing/PHEAA is the least terrible, with Great Lakes being a least-terrible alternative.

For the record, my experience and observation comes from examining hundreds of borrowers’ cases in the past five years, and lecturing to thousands of veterinary students and veterinarians. When I see and hear of errors in payment, plan choice or difficulty applying and correcting things, the servicer involved almost exclusively is Navient and Nelnet.

You can use loan consolidation to move away from servicers with poor reputations and move to or stay with one that has a better reputation.

Finally, as part of the federal Direct Loan consolidation process, you can choose to waive the remainder of your grace period (which I recommend) and select the repayment plan you’ll use once consolidation is complete. Whether or not you go on to use income-driven repayment (more on that in a minute), it makes sense to use the grace period to get your loan repayment plan started, ideally before you begin your first job, internship or residency. That way, you can qualify for a zero-monthly-payment due for the first 12 months of the loan-repayment period.

Calculate debt-to-income ratio

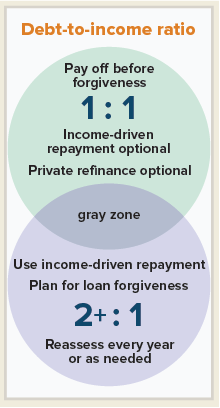

Choosing a repayment plan is not easy. Enough options are available to give anyone a case of analysis paralysis. One simple technique for guiding your decision is determining your debt-to-income ratio (DIR). To calculate DIR, take the starting repayment balance figure you derived from your inventory exercise, and divide it by your anticipated income. For example, if your starting repayment balance is $200,000 and your anticipated income is $75,000, your DIR is 2.67.

If your DIR is two or greater, plan for income-driven repayment. The available plans new graduates should consider are Income-Based Repayment (IBR), Pay as you Earn (PAYE), or Revised Pay as you Earn (REPAYE). Under these plans, your minimum monthly payment is based upon your income, generally 10 to 15 percent of discretionary income. This allows you financial flexibility as you get started in your veterinary career by reducing the risk of having a burdensome amount of your monthly disposable income go to the student-loan payment.

The other benefit of income-driven repayment plans is the promise of loan forgiveness: Any balance remaining after 20 to 25 years of qualifying payments is eligible for forgiveness. It’s important to recognize, however, that under current U.S. Internal Revenue Service rules, forgiven student debt is treated as taxable income. So if you use an income-driven repayment plan and anticipate having a balance to forgive, it’s important to set up a forgiveness saving plan to cover the tax hit.

Earlier, I mentioned timing loan consolidation in order to have your minimum monthly payment equal zero for the first 12 months of loan repayment. This is especially desirable for those with debt-to-income ratios of two or greater. If you have a tax return from your last two years of veterinary school or you apply for loan consolidation before you start working, you’ll have a good chance of minimizing that initial monthly payment. And yes, zero-dollar monthly payments under income-driven repayment count toward forgiveness.

If your DIR is equal to or less than one, choose a standard 10-year repayment plan. Student loan repayment originally was designed so that the borrower would have a monthly payment equalling about 10 percent of income, with the loan balance reaching zero after 120 months of payments. That was before average student-loan balances escalated.

If you’re fortunate enough to be below average in this regard, you may find that your monthly payment is less than 10 percent of your income under the standard payment plan. In that case, consider paying more than the minimum so that your payment equals 10 percent of your income. That will reduce interest, resulting in a lower total repayment cost, and it will shrink the time needed to pay off the loans.

If your DIR falls between one and two, you still may wish to use an income-driven repayment plan, letting your income determine the loan term and total repayment cost. If your DIR approaches one after a few years of practice, you’ll likely pay your loans to zero in a little more than 10 years. If your DIR is closer to two, you’ll continue to pay based on your income, and maybe even qualify for loan forgiveness down the line, depending on the plan you choose and your personal circumstances. Either situation is financially prudent because you’re allowing your income to determine how much you pay on your student loan rather than having your principal balance, interest rate and repayment term drive the amount due each month, regardless of your ability to pay that sum.

Tying your monthly payment amount to income allows you the flexibility to build a personal financial wellness plan — which may include saving for emergencies, retirement, loan forgiveness, a house, kids, your own practice, even (gasp) the occasional vacation — while managing your student-loan repayment.

The details of managing loan repayment vary greatly between income-driven repayment plans and the standard 10-year plan. If using income-driven repayment, set yourself several reminders (this is important, so one reminder is not enough) to renew your income documentation annually. You’ll also need to analyze your repayment plan each year as your circumstances change. For that, I refer you to the VIN Foundation Student Debt Center and Loan Repayment Simulator. Whichever tools you use, the goal here is to help graduating veterinarians make loan repayment simple again!

About the author: Tony Bartels graduated in 2012 from the Colorado State University combined MBA/DVM program and is an employee of the Veterinary Information Network (VIN). He and his wife, a small-animal internal medicine specialist practicing in Denver, have more than $400,000 in veterinary-school debt that they manage using federal income-driven repayment plans. By necessity (and now obsession), his professional activities include researching and speaking on veterinary-student debt, providing guidance to colleagues on loan-repayment strategies and contributing to VIN Foundation initiatives. Beyond debt, his professional interests include small- and exotic-animal practice. When he’s not staring holes into his colleagues’ student-loan data, Tony enjoys fly fishing, ice hockey, camping and exploring Colorado with his wife, Audra, and their two rescued canines, Herbie and Addi.