Dr. Casey McMahon

Photo by Erin Platz

Dr. Casey McMahon is coping with heavy student debt using a counterintuitive strategy that involves letting her loan balance rise.

Two years ago, I was fortunate enough to graduate from veterinary school. This was incredibly exciting but also terrifying because my student loans were becoming something I had to address. I was now dealing with the fact that I was graduating from one of the most expensive veterinary schools in the country, with no financial help from family or scholarships. The price tag was obviously a consideration when choosing a school; nonetheless, I had a dream, and the cost was so high and so unreal, it might as well have been priced in Monopoly money. Upon graduation, the amount I owed still didn't feel real, but I had to come up with a solution for my problem.

After graduation, I consolidated my (entirely federal) student loans and ended with the grand total of $380,000 in educational debt. For those who are curious, this debt is solely the cost of going to veterinary school and living expenses, including interest. I was very fortunate to have been able to go to an in-state university for undergrad and had financial support from my family to graduate completely debt-free prior to starting veterinary school. As far as living expenses, I lived quite frugally. I shared a house with six women (and two to three dogs and three to eight cats, plus or minus one rabbit, depending on the time). My portion of the rent was $550 per month.

In the two years since graduation, while I have been in an income-driven repayment program, my student loans have accrued $40,000 in interest, so my educational debt now totals $420,000. The crazy thing now is that while I do obsess over these numbers, they don't stress me out. I plan to use an income-driven repayment program until, after 20 years of making qualified monthly payments, my student loan is forgiven.

With this strategy, my monthly payments will increase or decrease relative to changes in my income. Interest will accrue monthly on my loan, but I won't be charged interest on interest. I will eventually be rid of the debt while also saving for other financial goals and living comfortably.

Coming to terms

Starting in the first year of veterinary school, different organizations would bring in speakers to discuss student loans and the pros and cons of paying off debt quickly. Most of the speakers would mention that if you pay off your debt quickly, you won't have money in the bank for other opportunities such as buying a house or owning a practice. At this point, someone would inevitably argue about the cost of interest accrual and the cons of relying on government programs. I listened to both sides but was usually more focused on the upcoming exam to care much, one way or the other.

Come third and fourth years, I finally bit the bullet and assessed the cost of paying back the loans. It quickly became clear that if I planned to pay my loans back as soon as possible, I would not be able to pay rent or buy groceries — my payment under the standard 10-year payback plan would be greater than $4,000 per month.

McMahon screenshot 1 320

Screenshot of VIN Foundation loan repayment simulation results

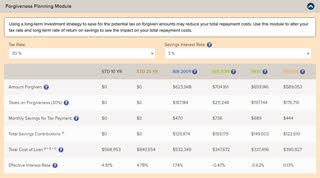

An online tool enabled the author to compare outcomes of different federal student loan repayment programs.

Click here for a larger view

I started to download every student loan resource I could find to better understand the different repayment programs. I was perplexed by how many there were and the differences between them. This search brought me to the free online VIN Foundation Student Loan Repayment Simulator and webinars by Dr. Tony Bartels, debt education director at the Veterinary Information Network, an online community for the profession.

The repayment simulator allows you to plug in your student loan information, expected income, tax filing status and other relevant data to generate projected payments under different repayment programs. I would spend hours with my friends comparing and contrasting how different repayment plans, salaries, marriage and consolidation would affect our loans.

After many sleepless nights and hours spent obsessing, I established a plan to make qualifying income-driven repayments with Pay As You Earn (PAYE), which is one option available for my federal student loans. Under PAYE, I will pay 10% of my discretionary income for 20 years. After making qualifying payments for 20 years, if I still have a loan balance, it will be forgiven.

As a single person without dependents, I found that this option, of the repayment programs available, allows for the lowest monthly payments for the shortest duration.

(Note: For the purposes of PAYE and most other income-driven repayment programs, the federal government defines discretionary income as taxable income minus 150% of poverty level, as determined by the U.S. Department of Health and Human Services. You can learn more about it on this page of the VIN Foundation Student Debt Center.)

The major caveat to my strategy is that if I have a balance to be forgiven in 20 years, the forgiven amount will be taxed as income and I will owe a lump sum in taxes. My loan repayment simulation projects that in 20 years, with an annual income growth rate of 3.5%, my educational debt will be approximately $670,000 due to the interest that will have accrued. The simulation also shows that I will have made payments totaling $180,000 over the 20 years (again, based on projected salary over that time). The balance that is forgiven after those 20 years of qualifying payments in the PAYE program will be taxed as income. The projection shows I will owe in taxes (assuming approximately a 30% tax rate) about $200,000 at that time. That means I will be paying the government $380,000 in total, which, interestingly, is exactly the amount I owed upon graduation.

A tax bill of $200,000 is another scary figure but, again, I have a plan. I know this amount will be due in 18 years (since I am now two years into repayment), so I have started saving a small part of every paycheck to go toward this tax bill. I have chosen to invest the money I am saving. This will hopefully allow me to earn higher rates of return than a bank savings account over the course of 20 years, enabling me to reduce the total cost of repaying the loan.

Once I decided my repayment strategy, I had to decide if and when I would consolidate my loans. Consolidation would essentially lump all my loans from each semester, and the interest they had accrued, into one large loan, with one interest rate that was an average of the interest rates of each of the loans. It felt like a very scary process, and I could have put it off because my loans allowed for a deferment or grace period of six months after graduation.

Most conversations about student loans assume that borrowers will take this six-month grace period, and it felt like a mistake to consolidate my loans any sooner. The assumption is that new graduates will want to start earning an income before beginning to repay their loans. However, I found that by consolidating my federal loans and starting the payment process immediately upon graduation, I would actually save money.

Why? First, calculating my income-driven repayment immediately after graduating worked to my advantage because at that time, I had an adjusted gross income (AGI) of zero dollars. Therefore, my income-driven loan payment was also zero. If I waited six months to calculate my repayment amount, I would be working full-time, which would bump up my required per-month payment for my first year of payments.

Second, if I were to postpone making payments, I would accrue interest on each loan for six additional months. This would add almost $10,000 to my loan balance before consolidation. The $10,000 would become part of my loans' principal balance, meaning I would then be charged interest on the interest. The student loan simulation showed that the extra $10,000 on my principal would add approximately $1,000 a year more in interest. After running the numbers, it became clear that I should consolidate my loans as soon as I possibly could.

What the PAYE plan looks like for me

McMahon screenshot 2 320

Screenshot of VIN Foundation loan repayment projection

The simulation tool shows the trajectory of the author's loan balance over time under different repayment programs. In the program she selected, PAYE, the balance continually rises but is forgiven after 20 years.

Click here for a larger view

Goal: 240 total qualifying payments

Payments 1-12: $0 minimum monthly payment due

PAYE rules allow for your AGI from a recent tax return to be used to calculate a minimum monthly payment due. (You may also report zero taxable income if you have no income yet, or you can provide documentation of your income using something like a pay stub from your employer.) When I enrolled in the program, I had not yet started working. My monthly payment was calculated based on my tax return for 2017, when I was in clinics and not making an income. This put my monthly payment at $0. (To my colleagues still in school: Be sure you file a tax return by April 15 of your fourth year.)

The scary part with this was wondering if my loan servicer would actually count these $0 monthly “payments” as qualified payments. I asked numerous people at the company if these payments would count toward my repayment, and they always responded yes. But I was still uneasy because I have trust issues. (Who doesn't, at this point?) Last month, I decided to ask for documentation that I had been in an income-driven repayment plan since August 2018. To my relief, it appears I truly was, and I have documents to support that. I strongly recommend to anyone in a similar position to just ask for the documents, so you have them for your peace of mind.

Payments 13-19: $150/month

While using an income-driven repayment plan like PAYE, you have to provide income documentation at least annually to continue having payments based on your discretionary income. After a year of not having to dedicate any money directly to my student loan repayment, it was time to pay. To recertify my income for the plan, I submitted my 2018 tax return. I had started working in July that year. My return therefore reflected half a year's salary, thus keeping my monthly payments low. By March of this year, I had spent just under $1,000 on my student loans.

Then something crazier than my student loan debt happened: COVID-19. Via the Coronavirus Aid, Relief, and Economic Security (CARES) Act, the government stopped requiring payments, and suspended interest accrual, on all federal student loans from March 13 through September. No one could have seen this one coming. And the U.S. Department of Education recently confirmed that the suspension on debt payments will continue through Dec. 31 by executive order. Because of this pause on interest accrual (based on the student loan repayment simulators), I will save between $10,000 and $20,000 on that tax bill I mentioned earlier.

Payments 20-29: $0/month

COVID-19 relief

Payments 30 on: To be determined

So far, I've paid about $1,000 in two years on my student loans. As a fourth-year student trying to predict the future, even armed with the VIN Foundation Student Loan Repayment Simulator, I had no idea how manageable my student loan debt would be. To be honest, I'm sure I wouldn't believe someone if they had told me this would be the case. It seems too good to be true.

What did I do instead of paying down student loans in the past two years?

I quit my job. My first job was destroying me. I went through four years of vet school without therapy and medication for anxiety (in hindsight, maybe I should have changed that ... ), but a handful of months into this job, I was a mess. Fortunately, because I wasn't throwing all of my money into my debt, I was able to build savings that allowed me to comfortably quit my job for a couple months and make a lifestyle change.

After quitting, I moved out of the city I lived in and spent the holiday season with family and friends. Because I wasn't in a rush to find a new job, I was able to pick one that I felt provided a better work environment and suited me better. Having money in savings was literally life changing. Today, I'm in a new position that not only makes me happier but pays more. Since settling into the new job, I've been able to start maxing out my retirement contributions while also saving for a down payment on a house — things that would be extremely difficult to do if I were not using a repayment plan like PAYE.

Full disclosure: While I am comfortable with my student debt, nobody else in my life is. My mom still doesn't know these numbers because I'm pretty sure they would make her vomit. When she asked me about paying my student loans down, I told her about income-driven repayment programs and she let me know that what I was saying couldn't be true. She told me about how debt is bad, and how I should just put as much money as I could into paying it down.

My old boss also would tell me about the importance of paying it off quickly, how he struggled but successfully paid off his student debt of about $40,000 when he first started.

And my boyfriend just went gray when I told him about my debt, but to his credit, he said, "That's a lot but I'm sure you can handle it."

Despite the skepticism of those closest to me, I am fortunate to have some of my best friends and colleagues in similar student debt conundrums. This has helped me feel confident in my plans and given me people to bounce ideas off, as I consider where to go in the future.

I'm writing this "loan-niversary" article in case there are others who are unsure if what they are doing is right. My student loan repayment strategy is not anything I hear about from family or mentors. I would be sure I was crazy or wrong if it weren't for obsessive research and discussions with friends. I am really glad I am using an income-driven repayment program. PAYE has already helped me better my life, and I am sure it will continue to help as I continue my veterinary career and pursue my financial goals.

About the author: Dr. Casey McMahon is a graduate of the University of Connecticut and the University of Pennsylvania, where she earned her VMD. She is now a small animal general practitioner in Philadelphia. Outside of work, she enjoys furthering her education in personal finances, spending time with family and friends and telling her cats they do not need more food.