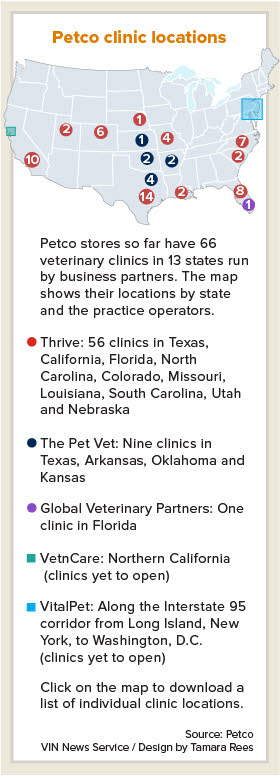

Building veterinary clinics at an increasing clip, Petco now counts 66 locations in its national chain of stores, anticipates having 100 clinics by the end of January, and could double that number to 200 by early 2021, according to the retailer's head of veterinary medicine, Dr. Whitney Miller.

Building veterinary clinics at an increasing clip, Petco now counts 66 locations in its national chain of stores, anticipates having 100 clinics by the end of January, and could double that number to 200 by early 2021, according to the retailer's head of veterinary medicine, Dr. Whitney Miller.

Petco doesn't intend to incorporate clinics at all of its approximately 1,500 pet stores, in part because of space restraints. "We want to be very targeted," Miller told the VIN News Service. "While we don't have the final top of the mountain, at this point, it's unlikely it would ever approach 100%. It's about providing the access to care in the right stores and markets."

As part of its expansion in the veterinary realm, Petco announced in August that it has agreements with three more businesses to own and operate in-store practices. They are:

- Global Veterinary Partners, which has five freestanding clinics in Florida

- VetnCare, which has seven freestanding clinics in Northern California

- VitalPet, which has 24 freestanding hospitals in seven states, predominantly Texas

The first clinic operators to ally with Petco were Thrive Affordable Pet Care and The Pet Vet, both based in Texas. Petco's first clinic, operated by Thrive, opened October 2017 in Aldine, a suburb of Houston. (In 2009, Petco leased space to The Pet Vet in Frisco but that arrangement predated the company's national push into veterinary services.)

Asked how Petco chooses its partners, Miller said: "When we're looking at priority markets that we want to expand our vet hospitals into, we really look for those quality veterinary providers that are already in that market, that know that market, and that have the interest in working with Petco and see the value of partnership with a pet specialty retailer."

Petco seeks "strong cultural alignments," as well, she said. The culture Petco aims to support is one in which "veterinarians are driving the medical practice; they're not dictated to on diagnostic plans; [and] they have the flexibility of practicing medicine the way they want," Miller said.

Notwithstanding Petco's own status as a large chain with foreign owners (CVC Capital Partners, a private equity firm based in Luxembourg, and the Canada Pension Plan Investment Board), Miller said the company aims to foster a "localized veterinary experience that isn't cookie-cutter."

Here is a look at Petco's newest clinic operators.

Global Veterinary Partners

Global Veterinary Partners, or GVP, is headed by Chris Viotti, a former airline pilot and flight school owner who is married to a veterinarian.

Viotti stopped flying professionally "because I didn't want a divorce; I was never home, you know?" he said. So he quit the airline, sold the flight school and put the money into veterinary hospital ownership. The couple opened their first in Weston, Florida, six years ago.

"I didn't come into it because of money," Viotti said. "I came into it because of love."

Today, he oversees five standalone hospitals in eastern Florida that operate under Zoe Animal Hospital, an entity previously known as United Animal Care.

VetCo 280

Photo by Chris Cooper

Global Veterinary Partners made its Petco debut at a store in Deerfield Beach, Florida, in July. GVP operates five standalone hospitals in Florida under the name Zoe Animal Hospital. Its Petco clinics are branded as Vetco Total Care.

The first four hospitals he built with his own means, Viotti said; then he created GVP as a private equity company to bring in investors to fund further expansion.

GVP opened in its first Petco location in July in Deerfield Beach. Viotti anticipates having 14 in-store clinics, all in Florida, by the end of 2020.

Viotti said he talked with PetSmart, another large retail chain, as well as Petco about operating store clinics. PetSmart has a long history in veterinary medicine — since 1994, it's housed Banfield Pet Hospital clinics in many of its stores. Last year, PetSmart began looking beyond Banfield for clinic operators. (See sidebar.)

Viotti and his spouse, Dr. Jitka Markova, who is medical director of GVP hospitals, said they judged Petco as a better fit, with an environment they favored.

"Where I live, there's a Petco, and across the street, there's a PetSmart," Markova told VIN News. "I prefer Petco for shopping because of the way the stores look, and the quality; the people are friendlier and more helpful."

Markova said she perceives Banfield to be highly standardized in its approach. "I think most every Banfield is the same, from what I'm hearing from my friends who work there," she said. "We want to be really strictly individual."

A uniform style, she said, can work for businesses like the hardware giant Home Depot, where a product "doesn't have feelings and doesn't need anything. But medicine, you cannot standardize. It's not black and white. It's 50 shades of gray."

Markova said GVP intends in its Petco locations to offer a broad range of services, far beyond preventive medicine. "We're more like an urgent care walk-in; we want to do everything," she said. At the same time, they will not hesitate to refer out cases if need be, she added: "If you have something that's complicated, we don't want to keep it in-house."

GVP's Petco clinics are branded as Vetco Total Care. The company originally sought to identify as United Animal Care, Viotti said, but found the word "United" to be so ubiquitous in business that obtaining a trademark was difficult. Petco proposed Vetco Total Care. "Vetco" is Petco's name for its mobile vaccination clinics, which are unrelated to GVP; Viotti said he hopes customers won't be confused.

Related to GVP's expansion ambitions, Viotti and Markova said they have a hard time filling vacancies, so the company is negotiating with a private university in Florida to start a new veterinary program to increase the supply of available graduates. The endeavor could prove controversial in a profession that long has debated appropriate workforce size and related issues.

GVP's concern is ensuring its access to high quality job candidates. Viotti said large employers such as Banfield seem to have direct pipelines into the veterinary programs at the schools nearest him — the University of Florida and Ross University in the Caribbean. "They come in, they buy lunch, they buy dinner. ... They build the relationship before they've even graduated," he said. "I don't have the means to compete with that."

That's why his company is exploring a novel approach: training their own. "Our investors pledged $48 million to buy a 48-acre piece of land in Fort Lauderdale for that university to get a veterinary [school], and our hospitals would [provide] the clinical training," he said. Viotti said a nondisclosure agreement prevents him from publicly identifying the university.

PetSmart eases beyond Banfield

Additionally, Viotti and Markova have proposed to the University of Veterinary and Pharmaceutical Sciences Brno in the Czech Republic — Markova's alma mater — to apply for U.S. accreditation by the American Veterinary Medical Association Council on Education. (Outside of the United States and Canada, the COE has conferred accreditation to 15 foreign programs; the latest was Seoul National University in Korea, accredited in December 2018.)

Viotti said the Czech veterinary school is much less expensive, even for foreign students, than its counterparts in the U.S., on the order of $18,000 per year. He and Markova said they are helping one of their veterinary assistants attend school there. She is starting her second year, and has a job waiting when she graduates, Markova said.

VetnCare

A native of Australia, Dr. Andrew Moffatt arrived in the United States almost eight years ago by way of New Zealand and England. A colleague he knew from veterinary school had called to ask if he'd like to help run a practice in Castro Valley, California, that his great uncle was looking to sell. That hospital ended up being the first of seven now managed by VetnCare Inc. Moffatt is the CEO.

VetnCare provides central administration but each practice remains a separate business, Moffatt said, and each existing location has a senior veterinarian who earns equity in the business up to a maximum of 25% in five years.

Enabling veterinarians to share in practice ownership is a business goal born of Moffatt's early career experience. While in England, Moffatt said, he worked for CVS Group plc, one of the largest veterinary consolidators in Europe. There, he learned the pros of consolidated ownership — mostly, operating efficiencies and benefiting from economies of scale — as well as the cons.

"What we lost was the individuality of each practice; the unique and special cultures that are community-based. We lost local leadership, decision-making at a local level," Moffatt said. " ... It was being managed by retail executives. They understood the numbers but they didn't understand client and patient care. That was a massive disconnect."

In California, Moffatt looked for a way to fund VetnCare's growth without taking investments from outside the veterinary community. "I'm fiercely against that," he said. "It stands against all my values. We're not a veterinary-led corporation if we have private equity. ... When you have people who own the majority of your company, and they've given you millions of dollars, they make the decisions. And they're not clinical people," he said. "I think, when guided by money alone, with clinical decisions become secondary, we've lost what we stand for."

Moffatt read an article about Petco's plan to remodel many of its stores to incorporate veterinary clinics. He contacted the company.

"I told them a bit of our story and how we're passionate about veterinarians owning their practice," Moffatt recounted. "... And Petco, hats off to them, pretty early on said they really liked the concept."

Over the months of working with people at Petco, Moffatt said he's found them involved, collaborative and humble — not what he thought a big company might be. "It was so refreshing," he enthused.

Because establishing brand-new clinics in Petco will entail more sweat than running an existing clinic, Moffatt said each site's senior veterinarian will be able to earn up to 40% ownership in the Petco locations. Those shares could be divided between two senior clinicians at a given site, with each earning 20% equity. Registered veterinary technicians also are qualified to share ownership, provided they pair up with a veterinarian, Moffatt said.

In the coming year, he added, he plans to offer profit-sharing to all VetnCare staff.

Moffatt anticipates opening VetnCare's first two Petco hospitals at the end of January. Over five years, he expects to be in 30 to 50 stores in Northern California, chiefly in the San Francisco Bay Area. Moffatt also expects to acquire six more existing standalone hospitals in the next six months.

VitalPet

Benjamin Thomas, a businessman, founded VitalPet 10 years ago with the purchase of four hospitals in the Houston area, according to Jackie Longstaff, associate director of marketing and brand strategy at the company.

Today, VitalPet owns 24 hospitals in seven states: Texas, New York, Colorado, New Mexico, Louisiana, Arkansas and Florida. Texas has the most locations, with 14. The second-largest cluster is in the New York City area, with five sites.

Longstaff described VitalPet as "very focused on DVM-driven medicine. No cookbook medicine, no home-office-driven medicine."

The style and offerings of each practice is shaped by the interests of its doctors, she said. "If we have a DVM who likes to do orthopedic surgery, that might be a focus of their hospital. We have one is who focused on rehabilitation medicine, so they have an underwater treadmill.

"A slogan of ours is 'benefits of ownership without the burden.' So we handle the back office, but don't get in the way of the medicine," Longstaff said.

In addition, most of its practices have a veterinarian who is an owning partner in the hospital, she said. That person might be an original owner of the practice or a medical director who joined a practice after the original owner left.

Up to now, VitalPet has grown by buying existing hospitals. When Petco contacted the company, its leaders saw a chance to grow much faster.

With the rising prices of established practices, she said, aligning with Petco, which is building and equipping the clinics, "was a good opportunity for us to continue growing the company through not just acquisitions. We're not stopping acquisitions, but this is another avenue," Longstaff said.

The marketing emphasis of the in-store clinics is convenience. "Open weekends, nights, walk-ins available," Longstaff said, adding that the location in a store enables customers to, for example, get their pet's wellness exam and pick up cat litter in the one stop.

An area of expertise that VitalPet hopes to cultivate in its Petco clinics is medical care for exotic animals and pocket pets — reptiles, guinea pigs and the like. "Whatever Petco is selling, we want to be able to take care of it," she said.

The region assigned to VitalPet is the Interstate 95 corridor from Long Island, New York, to Washington, D.C., Longstaff said. The company expects to open its first in-store clinic in early December in Pennsylvania. It anticipates opening 10 locations by mid-2020, and potentially as many as 80 during the next five to 10 years.