Phoenix lab 320

VIN News Service photo

Phoenix Central Laboratory near Seattle is for sale after 30 years in business.

A takeover attempt by Idexx Laboratories encouraged by a disgruntled shareholder could prompt a bidding war for the largest independently owned reference laboratory serving the veterinary profession.

Up for sale is Phoenix Central Laboratory, a by-veterinarians, for-veterinarians holdout in an industry increasingly dominated by corporate behemoths of veterinary care and laboratory services. The regional laboratory derives its clientele mainly from Oregon, Northern California, Washington and Alaska.

Cascadia Capital LLC, an investment banking firm, is soliciting buyers on behalf of Phoenix, which is located outside of Seattle in Mukilteo, Washington. Cascadia reached out this week to Phoenix's competitors to query their interest in acquiring the lab. The price tag for Phoenix isn't public information. Idexx offered in January to pay $29 million, according to sources close to Phoenix.

Founded by veterinarians in 1989, Phoenix has 97 shareholders, each of whom can own up to 15 shares of the company. With Phoenix's 440 shares valued at an estimated $65,000 apiece, anyone owning the maximum amount could receive as much as $975,000.

With that in mind, shareholders have instructed board members to review buyout offers.

That's a 180-degree shift from an earlier position held by leaders at Phoenix, which was built on a philosophy that values independent business. Phoenix has rebuffed previous attempts by Idexx to buy the company.

However, impetus to sell has come from within. Shareholder and former Phoenix board member Dr. Bob Kramer has pushed Phoenix to sell to Idexx since July 2017. Kramer owns shares in both companies.

"Yes, I approached Idexx," Kramer confirmed in an interview with the VIN News Service. "... At the time I approached them, competition was increasing, and management was insufficiently equipped to deal with it."

With his pitch for the acquisition repeatedly rejected by Phoenix board members, Kramer addressed shareholders directly in February 2018 to apprise them of the buyout offer and ask for their support.

Idexx, a publicly traded corporation based in Westbrook, Maine, is one of the two largest veterinary diagnostic laboratories in the country; the other is Antech Diagnostics, a subsidiary of VCA Inc., a veterinary hospital chain owned by the international conglomerate Mars Inc. Together, Idexx and Antech dominate the markets in the U.S. and Canada.

Idexx was involved in an acrimonious acquisition at least once before. In 2006, it bought Vancouver-based Central Laboratories for Veterinarians, following a contentious bidding war with Antech and a battle between shareholders. The once independent laboratory now is part of Idexx Canada.

There is no evidence suggesting that Antech is interested in buying Phoenix. Correspondence between Phoenix leaders and shareholders confirms that Idexx, however, has been trying for several years to acquire the lab.

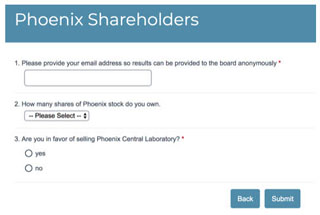

Poll 320

VIN News Service screenshot

Under buyout pressure by Idexx, Phoenix Central Laboratory emailed to shareholders on Aug. 19 a one-question survey to assess sentiment about selling the company. The survey results aren't public, but officials with the lab have since hired an investment banking firm to solicit would-be buyers.

Kramer's ongoing efforts to orchestrate the acquisition of Phoenix by Idexx appears to be having an effect. Last month, Phoenix leaders sent shareholders an online survey asking, "Are you in favor of selling Phoenix Central Laboratory?" Owners of two-thirds of all outstanding shares must agree to sell the laboratory before a deal can be struck. Roughly 90% of all shareholders have responded to the survey. An internal email circulating among shareholders reflected that "a majority" were in favor of selling. Phoenix CEO John Evans did not respond to VIN News requests to discuss the potential sale of Phoenix. Officials at Cascadia, contacted by VIN News on Wednesday, also did not respond.

In a statement to VIN News, Idexx affirmed its interest: "We believe uniting Phoenix Lab and IDEXX would provide tremendous value to Phoenix Lab shareholders, employees, patients, and customers, as well as to the veterinary profession."

VIN News was unable to ascertain whether Phoenix plans to limit buyout negotiations to independent suitors. Critics say that a deal with a large company would conflict with the philosophy on which Phoenix was founded in 1989, when veterinarians in the Northwest decided to open a reference laboratory that would work for them rather than for a major corporation.

Speaking on condition of anonymity for fear of inciting legal action, one Phoenix official put it this way: "The people who set up the lab 30 years ago wanted a lab that couldn't be taken over by a national corporate laboratory. The problem is many of those veterinarians have retired or have died.

"And, of course, we've been too successful. Idexx and Antech have bought up everybody and there's only a very few independent labs left."

News of a possible sale has reverberated through the profession, with rumors circulating that other laboratories also are mulling acquisitions.

Dr. David Gardiner, co-owner of ZNLabs, a small but rapidly growing independent veterinary reference laboratory headquartered in Louisville, Kentucky, laments the possibility that Phoenix might end up in the hands of Idexx.

Asked why, Gardiner reflected on a call he received a few years ago from the Federal Trade Commission. The agency, he said, was trying to gauge whether Antech's purchase of Abaxis Veterinary Reference Laboratory might adversely impact competition in the industry.

"Obviously, they decided, 'no,' " he said, given that the $21 million deal closed in spring 2015. "But they called a number of us to hear our thoughts. I told them that for a small laboratory without access to large amounts of capital, it is nearly an impenetrable duopoly. And if one of the two dominant players (Idexx and Antech) picks up another lab via acquisition, it only further strengthens the duopoly."

Kramer considers a deal with Idexx to be a proactive response to a rapidly changing market. The proliferation of corporate practice chains, he said, is draining the pool of practice owners who can choose an independent reference laboratory and aren't contracted to do business with Antech or Idexx.

"It's about the Phoenix shareholders, first and foremost," he said. "It's about protecting their investment."