Matt Salois

AVMA photo

AVMA Chief Economist Matt Salois expects that U.S. market conditions will remain volatile for the foreseeable future.

The popular narrative is that the COVID-19 crisis of 2020 fueled a rush of pet adoptions, driving demand for veterinary services and causing a workforce crisis in the profession.

This common belief, however, is not entirely accurate, says Matt Salois, chief economist of the American Veterinary Medical Association. While "there's some truth to the prevailing view," he says the reason is not that they're experiencing an extraordinary amount of new business.

"The reality is, when you dig into the data, a more nuanced and balanced view emerges," Salois said last week during a video presentation to the AVMA House of Delegates. "... What the data tells, also, is a more complicated story on why burnout and busyness is such a pervasive problem in the profession right now."

Based on research by the AVMA and other sources, he reported:

- The so-called pandemic pet boom is exaggerated; numbers of dogs and cats adopted from shelters in 2020 actually was a five-year low.

- New clients contribute to increased busyness but a demand backlog by existing clients is driving the bulk of veterinary visits.

- Protocols to protect against the spread of COVID-19 have reduced productivity.

- High staff turnover is intensifying busyness and burnout.

Addressing the refrain that pets were adopted in droves during the pandemic lockdown, Salois said, "[T]he data is very clear that there was not a boom of adopted pets from shelters," according to a recent survey of 4,000-plus pet shelters across the country. He noted, "While shelters aren't the only source of pets, they are the primary source of newly adopted pets," citing findings of the 2017-18 AVMA Pet Demographic Study.

Difficulties and delays for those wishing to adopt were attributed to a boom in demand but were actually caused by a shortage of available animals, Salois explained. Successful spay-neuter programs, fewer relinquishments and a decline in strays picked up by animal control officers have impacted shelter populations.

Even so, practices are busier than before the pandemic, Salois said. Data from the Veterinary Industry Tracker, an economic tool developed jointly by the AVMA and VetSuccess, show that average monthly appointments booked per practice grew 4.5% year-over-year in 2020, and 6.5% by mid-2021.

Those are robust rates, Salois said, but asked: "Is growth of 4.5% or 6.5% 'epic' or 'skyrocketing'? The growth is healthy, for sure, without question, and potentially, one can even say unprecedented. But is it enough to send practices and staff into a tailspin? Is it enough to send our workforce into a state of crisis?"

The economist acknowledged anecdotes of appointments growing by 20% or more — the kind of double-digit growth that "can wreak havoc on busyness." But looking at the national picture, Salois said, that's not what's happening in aggregate.

What does the data show?

Information collected by VitusVet, a provider of practice management software and services, shows that the proportion of practice revenue from appointments with new pets began to increase in late April 2020. This is in contrast to the first quarter of 2020, in which new-patient revenue dipped compared with the first quarter of 2019. During the remainder of 2020, growth in the share of new-client practice revenue continued to climb over the previous year, peaking at 17%, but has flattened in 2021.

VetSuccess data, which looks at the share of practice revenue coming from new clients, shows that new clients had a modest impact on the veterinary economy with revenue growing only slightly since before the pandemic. "Yes, new clients did contribute to growth, but the bump wasn't epic," Salois said. "… [T]here are other more significant factors driving a sense of busyness in practices."

Among the drivers have been pandemic-related disruptions in the pattern of bookings at practices. With clinics closed or performing only emergency services in spring 2020, wellness visits and other exams often were rescheduled, creating a logjam in demand for services. Pandemic-related changes adopted by practices — transitioning to curbside care, splitting staff into rotating teams, and deep cleaning after every appointment — also contributed to productivity and efficiency challenges, Salois said.

"As practices tried to catch up with the backlog, teams were stretched to the limit," he said. "Client services [and] efficiency undoubtedly suffered as the extra work was mixed with new safety measures."

"As practices tried to catch up with the backlog, teams were stretched to the limit," he said. "Client services [and] efficiency undoubtedly suffered as the extra work was mixed with new safety measures."

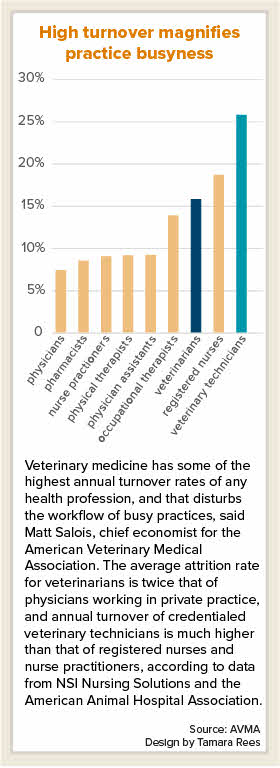

On top of that, add high employee turnover, an existing problem in the profession magnified by the pandemic. "Veterinary medicine has some of the highest turnover rates of any health profession," Salois said.

Busyness tied to productivity gaps

Data from AVMA surveys of practice owners conducted in April and July 2020 showed that the pandemic significantly disrupted productivity, which declined almost 25%, as measured by average patients seen by veterinarian per hour. Salois explained: "That means, for example, if a typical veterinarian saw four patients per hour prior to COVID, a 25% decrease says they're only able to see three on average per hour."

Reflecting on the 4.5% to 6.5% growth in practice appointments booked, Salois continued: "Again, that's healthy; that is encouraging growth. But a 25% decrease in productivity is what I would call 'epic.' It is hugely significant and hugely disruptive. ... Our practices are playing catch-up with patients that haven't been seen in a year, and practice teams still aren't working at peak productivity because of lingering conditions related to COVID-19."

Higher workload coupled with lower efficiency has intensified the high stress levels experienced by many in the profession, Salois said. Average client wait times doubled in 2020 compared with the year prior, according to the AVMA COVID Impacts Survey, with 25% of practices reporting wait times of 30 minutes or more. Average wait times previously were reported to be between 10 and 20 minutes.

What's the outlook on demand?

It's unknown whether demand for veterinary services in the U.S. will continue to increase, and if so, for how long. Salois notes that consumers still are benefiting from "positive but temporary shocks to the economy," such as increased disposable income from stimulus payments coupled with reduced spending in other areas. Owners are still spending more time at home with their pets, and demand continues for veterinary services that were postponed during the pandemic shutdown.

"Markets and consumer reactions to business conditions are going to remain volatile for the next several months, at least," Salois said. "What this means is that we can't count on business conditions today to be the same next year, or even a year later."

More veterinarians not a solution

To address productivity gaps in the profession, Salois cautioned against strategies such as expanding the supply of veterinarians and veterinary technicians. "This is not going to address the major underlying issues driving busyness ... for a variety of reasons," he said.

Salois likened adding veterinarians to the workforce to filling a bathtub with an open drain. "You can crank up the faucet, you can pour more water into the tub, but you are not going to fill that tub," he said. "The drain is going to win. That's what the inefficiency problem is like, as well as the turnover challenges that we are experiencing."

What's more, it takes time to expand school capacity to accommodate more veterinary students, and then at least four years to graduate them. "None of that helps what practices are feeling right now," he said. "... We don't need a five-year plan; we do need a right-now plan. Throwing more people into a difficult environment doesn't fix the problem."

Here's what he suggests:

- Retool appointment reminders to create a more manageable flow of patients.

- Use technology to automate and streamline tasks, such as inventory management and accounting.

- More effectively use talent, including that of technicians and veterinary practice managers.

- Establish a culture in which staff feel informed, engaged, inspired and valued.

"Taking action to leverage technology, empower talent and engage the team are all things we can do today," he said.