VIN News Service photo

Metallic plates on the left sides of the credit cards indicate that they are embedded with a computer chip for more secure transactions. Cards are “dipped” into a reader for processing. Chipped cards have magnetic strips, too, so they can be swiped as usual at businesses that don’t have chip readers.

Veterinary clinics, along with all businesses in the United States that take credit-card payments in person, are being pressed by card companies to upgrade their processing equipment by Oct. 1 or potentially be held liable if they accept counterfeit cards.

The switch is part of a move by the credit-card industry to replace consumers’ magnetic-strip cards with more secure cards containing computer chips. Cards with chips are dipped into a processing machine rather than swiped.

As explained on credit.com, the machine interacts with the chip: “In effect, the credit card and its reader have an encrypted conversation in order to ensure the credit card is valid, while a simple ... magnetic stripe merely recites your credit card number and expiration date to any machine that can read it. It is this vulnerability that allows credit cards to be so easily cloned for fraudulent purposes.”

To motivate card-issuing financial institutions to deploy chipped cards and to prod merchants to become capable of processing them, the credit-card brands — Visa, MasterCard, Discover and American Express among them — have adopted rules that shift liability for in-store counterfeit fraud to whichever party is least secure. The card and equipment changes are voluntary, driven by market incentive rather than government regulation. Players may stick with the status quo if they are willing to assume the liability.

Starting next month, if a bank fails to supply its cardholders with chipped cards and a thief counterfeits one of its old-style magnetic-strip cards and uses the phony card to buy something, the bank is responsible for the theft.

Alternatively, if someone fraudulently uses a chipped card issued by a compliant bank, and the merchant who processes the transaction does not have equipment that reads the chip, the merchant is responsible for the theft. Generally, equipment upgrades cost several hundred dollars.

The shift in liability applies only to in-person transactions, not payments made online or by telephone. For transactions made from automated fuel dispensers, the shift takes effect October 2017.

The chip-card standard is referred to as EMV, the initials of Europay, MasterCard and Visa, the companies that created the standard. Today, the standard is managed by EMVCo, whose members are American Express, Discover, JCB, MasterCard, UnionPay and Visa.

Chipped credit cards aren’t new. Credit-card companies deployed them in Europe a decade ago. Now they’re used all over the world, including Africa, the Middle East and Latin America, according to EMVCo.

“We have had chipped cards in Australia for a few years. No dramas,” Dr. David Tabrett, a practitioner in New South Wales, posted in a discussion of the U.S. transition on a message board of the Veterinary Information Network, an international online community for the profession.

Dr. Chris Booth, a practitioner in British Columbia, Canada, predicted, “In a year, you will wonder why the card processors felt they should wait … to introduce them to the USA.”

Major veterinary servicer not ready?

While card-issuers have been rolling out chipped cards for months, some merchants face a continued wait for chip-reading equipment.

The veterinary community in particular may be stymied by delays at AVImark, one of North America’s largest providers of veterinary software with integrated payment processing. AVImark, which is owned by Henry Schein Animal Health, sent an email to its customers Wednesday obliquely suggesting that it wasn’t quite ready. The email reads in part:

“Thankfully, fraudulent activity in veterinary hospitals is quite low, and while the liability shift takes effect as of October 1st, 2015, there is no real deadline as a merchant to have EMV equipment by this date. With the risk in veterinary hospitals being so low, some large practices have even decided not to make the EMV switch. Nevertheless, the AVImark team has been extremely busy ensuring that we have a certified, EMV compliant solution ready to offer our customer base.

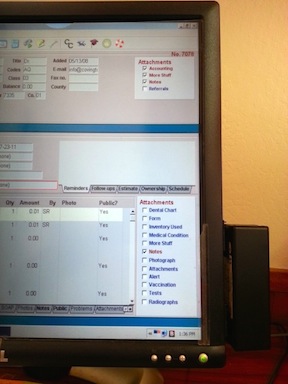

Photo by Niki Chaves

Veterinary clinics that process credit cards on an AVImark system integrated with their practice-management software run the card through a device attached to the computer. An email this week from AVImark to clients intimates that equipment capable of reading chipped cards may not be ready by Oct. 1.

“We are proud to announce that we are ready to begin assisting our payment solutions customers with their transition process. We have invested heavily in testing and certifying a solution to provide our clients, and though we cannot control the mandate, we can help answer your questions and aid in your transition. The good news is that we are offering an equipment rebate to our customer base in order to make the transition as seamless as possible so clinics are well prepared. Our team will be sending out more information on the equipment rebate very soon.”

At Covington Creek Veterinary Hospital in Fort Bragg, California, practice manager Niki Chaves was surprised not to have heard from AVImark earlier. Chaves said she learned about the switch to EMV cards and the need for new equipment only a couple of weeks ago when someone at her local credit union handed her a brochure.

Puzzled, Chaves made some calls. First, she telephoned Element Payment Services, the company that processes payments for AVImark customers. A representative at Element explained the need to upgrade the clinic’s hardware and pointed her to AVImark for the equipment.

The representative urged Chaves not to delay. “After October 1st, he says, ‘There’s nobody to help you; you’re on your own,’ ” Chaves recounted. “I don’t want to be on our own!”

On Tuesday, she called AVImark. After a long wait on hold, Chaves was told that the company was awaiting certification of its new chip-reading equipment. The email from AVImark arrived the next evening.

Chaves is disappointed by the delay. “I feel like we’re being left out in the cold a little bit,” she said.

Her clinic may be in good company. According to the AVImark website, its veterinary software is used by nearly 10,000 customers in the United States and Canada. Whether all software users also use AVImark's credit-card processing system is unclear. AVImark and Henry Schein Animal Health did not respond to requests from the VIN News Service for comment.

What to consider, what to avoid

It’s true that merchants aren’t obligated to switch out their processing equipment, nor is Oct. 1 a drop-dead date. Chipped cards still have magnetic strips that can be read by the old equipment. It’s just that merchants using the old system assume the liability if they happen to accept fraudulent cards.

“Veterinarians need to make a business decision to invest in the equipment or accept the risk,” said Phil Hinke, founder and president of Merchant Fee Savers LLC, a credit-card-processing consultant.

As chipped cards become commonplace, there’s another consideration. Consumers may come to look askance at a business that uses the swipe method, Hinke predicted: “I think customers will get to that point where they will look at the merchant who doesn’t have a chip device and think, ‘Boy, you’re behind the times. You’re affecting my security.’ ”

As for obtaining the necessary equipment, some credit-card processors are providing it for free, while others are charging a significant mark-up.

Hinke said a basic terminal is worth about $200; including what he would deem a reasonable mark-up puts the price at $300. Optional capabilities, such as being able to accommodate customers who use Apple Pay, might bump up the price a bit, but even with all the bells and whistles, the equipment should cost less than $400, he said.

Above all, Hinke advises not leasing equipment. “A lot of these companies are leasing this stuff for up to $99 a month for four years,” he said, substantially increasing the overall cost.

Moreover, Hinke said, a company leasing a terminal may not be the same as the company handling the processing. “The leasing company has a personal guarantee [of payment] from the merchant and doesn’t care if the provider is continuing to increase rates and fees or isn’t providing the service it promised,” he said.

Switch or stay?

Hinke also advises merchants who don’t get satisfactory deals on new equipment to consider switching processors altogether. “It’s actually a good time to look for a new processor, he said. “Just really evaluate — are you with the right company? If a company is coming down saying, ‘Hey, I’ll sell you this equipment for $600,’ then you’re probably not with the right processor.”

The field is competitive. Hinke said more than 1,000 companies sell credit-card processing services. (Most of those are resellers of services provided by about a dozen entities, called acquiring banks or acquirers, that actually process the transactions.)

While switching processors may save money, some businesses are choosing to stick with the familiar rather than chance the unknown. That’s the case at Weston Road Animal Hospital in Florida, where the owner, Dr. Sam Strauss, and office manager, Sharon Stone-Shim, opted for a $26.94-per-month lease from Bank of America.

The alternative was to buy the equipment for $755, Stone-Shim said. “If you purchase, you get a one-year warranty on the terminal,” she recited. “If it breaks or something goes wrong, you’re responsible. No supplies — no paper, anything like that.”

In the past 10 years, the hospital has replaced its terminals maybe twice, so breakdowns aren’t frequent, Stone-Shim said. But she worries that a chip-reading terminal may be more sensitive. “You’re getting into a more technical situation,” she said. “We’re in an environment where there’s dirt, hair; things get knocked around.”

As a customer of the bank for more than 20 years, the hospital used to receive terminal upgrades and unlimited supplies without charge, Stone-Shim said. Not this time. “No, they’re not going to give you a break because they know that everybody’s going to switch over,” she said. “I guess they realized they have everybody over a barrel.”

Despite Bank of America’s stance, the hospital was reluctant to switch processors. “If you try to go outside to get a new processing company, you have no idea who to go with,” Stone-Shim said. “I would love to go with some of these other companies, but when you calculate startup fees, you’ve got to sign contracts, all this stuff, by the time you’re done … you still don’t know who you’re dealing with.”

One other equipment decision for merchants is whether to buy a PIN pad. To maximize security, some on the industry believe customers should be asked to dip their card and enter a personal identification number to process the transaction. That’s how it’s done in many other countries. However, in the United States, most card-issuers are requiring customer signatures rather than PIN codes — a decision that’s drawn questions and criticism.

The potential exists for card issuers to adopt the PIN requirement eventually, which will make a PIN pad another piece of standard equipment for processing credit cards. Hinke said that it should be possible to obtain a PIN pad later if a PIN requirement kicks in.