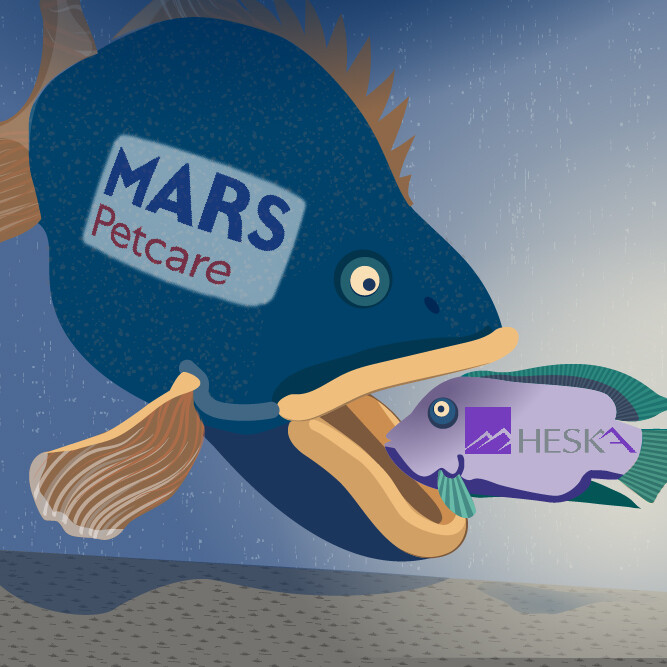

Little fish cooperates with being eaten

Mars Inc. has agreed to buy the veterinary diagnostics business Heska for $1.3 billion in a deal that would see the multinational company further strengthen its status as a dominant force in pet care.

Heska would add point-of-care laboratory equipment to a Mars lineup that already includes reference laboratory services sold through its Antech business, one of the two largest veterinary reference laboratories in the world.

Veterinarians use point-of-care instruments to perform diagnostic tests at their own practices, while reference laboratories conduct diagnostic tests off-site.

Mars' offer of $120 cash per Heska share is 23% more than the price of Heska shares immediately before the bid was announced, the companies said in a joint statement issued Monday.

Heska, located in Loveland, Colorado, is traded on the Nasdaq stock exchange — for now. Mars, best known as the maker of M&Ms and other confections, is a privately held company based in McLean, Virginia.

The proposed takeover has been accepted by Heska's board but remains subject to customary approval from regulators and Heska shareholders. The companies said they expect the deal to be sealed in the second half of this year.

The bid comes as ownership of veterinary assets globally becomes increasingly concentrated in the hands of large corporations. Mars is the world's biggest owner of veterinary practices, with more than 2,500 such sites under its control. It also is a giant in the pet-food market. Heska would become part of Mars Petcare, which includes practice brands such as Banfield Pet Hospital, BluePearl, VCA, AniCura and Linnaeus; food brands including Acana, Iams, Pedigree, Royal Canin and Whiskas; and Wisdom Panel dog and cat DNA test kits.

The veterinary diagnostics sector, too, has undergone rapid consolidation in recent years, although it has long been dominated by Mars' Antech lab and Idexx Laboratories — the latter offering both reference laboratory services and point-of-care equipment and supplies.

At least one veterinary pathologist anticipated the deal. "Surprised it took this long; it was the piece Mars was missing in their pet empire," said the pathologist, speaking on condition of anonymity owing to employer constraints. "They lacked a point-of-care product and rapid-assay product line."

Beyond Mars and Idexx, a third giant in the veterinary industry, Zoetis, entered the diagnostics realm in 2018 with the purchase of Abaxis, a maker of point-of-care diagnostic instruments. Zoetis, the largest veterinary pharmaceutical company in the world, followed that purchase with acquisitions of several full-service veterinary diagnostic laboratories in 2019 and 2020.

In an email to employees, Abhay Nayak, president of global diagnostics at Zoetis, characterized the Heska purchase as evidence that veterinary diagnostics is "an attractive and active investment area" that's competitive.

"So what does this mean for our global diagnostics business?" he wrote. "Most importantly, it reinforces that our strategy is sound, and we are committed to executing it with vigor." Nayak urged Zoetis employees to "stay focused."

Andrew Dusing, an industry analyst with Cleveland Research Company, said in an email to colleagues that post acquisition, the three largest providers of point-of-care veterinary diagnostics in order of size will be Idexx, Mars and Zoetis.

Idexx, based in Westbrook, Maine, has been a towering player in the point-of-care sector for years. In 2012, the U.S. Federal Trade Commission said Idexx had "monopoly power," with a market share of "at least 70% between 2006 and 2011, with no other firm having more than a 20% market share during that time." The regulator noted that more than 75% of veterinarians in the country used point-of-care diagnostic testing.

The FTC comments came in the context of a settlement order in which it stopped Idexx from entering into exclusive, long-term sales contracts with distributors of point-of-care products, deeming the contracts to be anticompetitive. Soon afterward, Idexx started selling the products directly to veterinary practices.

Mars' entry into the point-of-care market presumably will change the power dynamics. "It will be interesting to see how Mars approaches integrating Heska into their hospital network, as well as how they go after new hospitals with now-bundled offerings," Dusing, the industry analyst, mused.

At the same time, the FTC has been signaling concern about the rising power of large corporations in the veterinary realm. Last year, it forced another large owner of veterinary practices, National Veterinary Associates, to sell 11 specialty and emergency hospitals.

Similarly, following an FTC antitrust review of Mars' acquisition of VCA in 2017, Mars agreed to divest 12 specialty and emergency hospitals.

When it comes to Mars and Heska, however, the companies may contend that the proposed deal won't lessen competition because their respective offerings don't compete in the same market, given Antech primarily offers reference laboratory diagnostics, and Heska, point-of-care equipment.

The deal will bring together "highly complementary" businesses with a strong strategic and cultural fit, Nefertiti Greene, president of Mars Petcare Science and Diagnostics Division said in the news release. "This comprehensive diagnostic offering will mean broader coverage across diagnostic products, services, and technology, and will accelerate R&D for novel solutions."

Mars has bid for Heska at a time when shares in many animal health companies are struggling in the face of rising inflation and interest rates that investors fear are crimping consumer demand. Even after leaping 21% by the close of trading on Monday in the wake of the takeover announcement, Heska shares still were 18% below where they were 12 months ago.

Heska's sales revenue in 2022 edged up just 1.4% to $257.3 million year-over-year, having fallen 2.5% in the fourth quarter. The company booked a full-year loss of $19.9 million as sales were more than offset by research-and-development spending, acquisition-related costs and "other non-recurring items and extraordinary charges ..." according to the company's results filing.

Idexx shares fell 2.2% on Monday as investors digested the prospect of a beefed-up Antech being able to complete more effectively with Idexx.