Photo by Nikita Evans

Dr. Trevor Miller's student loan debt could be wiped away if he wins an online essay contest put on by his lender, Social Finance, Inc. The public must cast their votes by June 23.

To be clear from the outset, we don’t believe private loan consolidation or refinancing is a prudent option for most veterinary graduates with significant amounts of student debt.

Prudent option or not, Dr. Trevor Miller, a 2012 University of California, Davis, School of Veterinary Medicine graduate chose that route and now has an unusual opportunity to have all his debt paid off by his loan consolidator — and you can help by voting in a promotional contest for his essay.

Most of us recognize that Internet contests in which the public votes for a winner usually are ploys to attract contestants, attention and raise awareness about a service or cause — all without spending millions of dollars on advertising.

Still, as much as we don’t wish to encourage others to pursue this path — that is, private student loan consolidation or refinancing — we couldn’t pass up the opportunity to help a colleague who has made it to the finals of a competition to have his student debt paid in full.

So we agreed to help. We are also using this as a teaching moment. So please vote for Trevor and please read on.

The pitch

If you have significant student debt and a postal or email address, it is likely you’ve received a myriad of letters and emails from companies such as Social Finance Inc., or SoFi, offering to help you pay down your student loan debt cheaper, better, faster. Can it be that simple? A phone call? An online application? Done?

Keeping in mind the adage "If it sounds too good to be true, then it probably is," let’s take a closer look at private lender student loan consolidation, often referred to as student loan refinancing.

Trevor accepted a private consolidation loan with SoFi after landing his dream job that pays a higher-than-average veterinary salary. He subsequently entered the SoFi essay contest and is now one of 20 finalists, out of more than 2,400 entrants, with a chance to have his loans paid in full. We can help Trevor win this opportunity by voting for him. Voting closes Tuesday, June 23 at 11:59 PM Eastern time.

Caution: Voting requires entering an email address. Participants receive a link to validate the address. We are trying to find out how SoFi intends to use the email addresses but have not received an answer.

Trevor's story is a familiar one for recent veterinary school graduates. Here's an excerpt from his competition essay:

When I told family and friends I had decided to go to veterinary school an all too common response was "Why not med school? You'll make more money." When you're following a dream paychecks are an afterthought, so off to vet school I went. After four years of school and a year as an intern I had my dream job. I also had a seemingly insurmountable heap of debt.

Trevor has about $178,000 in veterinary student debt. He consolidated with SoFi at 5.74 percent with a 10-year term, resulting in payments of $1,953 per month.

We hope Trevor wins this contest to have his consolidation loan paid in full. Unlike the tens of millions of Americans with student debt, he now has a chance at living student-debt free.

But what should other recent veterinary graduates with mostly federal student debt do when offered private loan consolidation or refinancing?

Private loan consolidation can be a viable option, but it comes with risks. How comfortable are you giving up the flexibility and safeguards that only federal income-driven student loan repayment plans provide? These include:

- minimum monthly payments determined by your income rather than an amortization table

- forgiveness (taxable) after 20 or 25 years, depending upon the program

- lower risk of default because having no income results in a minimum payment of zero dollars

- interest that doesn't capitalize if you can't make the monthly payment

- the opportunity to consider Public Service Loan Forgiveness (non-taxable)

The decision depends on your personal circumstances as well as your short- and long-term career plans and goals.

The devilish details

Trevor provided us with details about his loans and financing to help us understand his decision and explore the risks and benefits of private-loan consolidation for others.

Upon entering repayment (after graduation and his six-month grace period), Trevor’s veterinary school loan balance was $156,000 — about average for a 2012 graduate.

Trevor could have deferred making payments during his internship, but he elected instead to use an income-driven repayment program. Income Based Repayment (IBR) is one of several repayment plans offered by the federal government under which loan payments are set as a percentage of the borrower's income. Depending on the plan, the borrower makes payments for 20 or 25 years or until the loans are paid off, whichever comes first. Any debt remaining after the maximum repayment period is forgiven. (Caveat: The forgiven balance is taxed as income.)

Going with IBR was a clever move by Trevor because he'd claimed no income on the tax return he filed during his final year of veterinary school. As a result, his IBR payments during his internship year were zero. His veterinary school loans accrued $22,000 of interest during that period at 6.8 percent.

Here's where things get more complicated. Under IBR, that $22,000 of unpaid interest would remain separate from his principal balance and not capitalize (be added to his principal balance for purposes of calculating interest) unless he switched repayment plans, consolidated or no longer demonstrated a partial financial hardship.

What is a partial financial hardship? It depends on how much you make and how much you owe. For example, a single person with $156,000 in federal student loan principal would not be considered in partial financial hardship if his adjusted gross income (AGI in tax-speak) was about $160,000 or higher. That's under IBR. The income level is higher for those who qualify for one of the newer federal income-driven repayment plans such as Pay As You Earn (PAYE).

Let's compare how Trevor would have fared had he stayed with IBR versus going with private loan consolidation.

If he had remained in IBR paying $1,953 per month (the amount he is currently paying after choosing private loan consolidation), his loan principal of $156,000 would have accrued about $883 of interest per month. The first $883 of his $1,953 payment would have gone toward that monthly interest accrual while the remainder was applied to the unpaid interest balance. Once the unpaid interest was paid off, the majority of his payment would go toward principal. He would have paid off his loan in 10 years and 8 months. $1,953 per month for 128 months totals $248,462. The amount of interest he would have paid over the next 10 years and 8 months is $70,452 ($248,462 minus $178,000).

Upon private consolidation, Trevor’s loan principal balance was $178,000 at 5.74 percent ($158,000 principal plus the $22,000 in interest that accrued during his internship). Consolidation, whether private or federal, always results in the capitalization (addition) of any unpaid interest to your principal balance. (Both private and federal loans offer a 0.25 percent interest rate discount by if you pay by auto-debit. We did not include the discount in this analysis.)

$1,953 per month for 120 months at a fixed interest rate of 5.74 percent totals $234,360. The amount of interest he will pay over 10 years (if he doesn’t win this contest) is $56,360 ($234,360 minus $178,000).

Here's how the two paths stack up:

The interest you pay on any loan is based upon the loan principal. As you can see in the table above, under IBR, Trevor's interest at 6.8 percent would have been calculated on the principal of $155,868 whereas under private consolidation, the interest will be calculated on a principal of $178,010.

In pure financial terms, assuming no unexpected bumps in the road for Trevor over the next 10 years, he will save about $14,100 through the consolidation.

Is it worth the savings?

For Trevor’s situation, this looks like a good deal. But no one can predict the future.

What if the unexpected happens? For example, what if his situation changes or he wants to pursue other opportunities that may not be so easy to pull off with a loan payment of nearly $2,000 a month?

Once you consolidate student loans with a private lender, you cannot go back to the federal system. That means you lose eligibility to change your payments based on income and family size. While there are some minimal deferment and forbearance provisions in most private loan consolidations, they lack anything close to the flexibility of the federal income-driven repayment plans.

Trevor's consolidation plan includes a death and disability loan discharge provision. More and more private lenders are including this provision for consolidation loans, but it may not be standard. If you go down this road, make sure you request that discharge provision if you do not see it. The last thing you want is to leave this debt for your family if something terrible happens to you. All federal loans are dischargeable in the event of death or disability.

Since Trevor has consolidated his loans with SoFi, we can assume that the $1,953 payment he is making and will continue to make for the next 10 years is currently affordable for him.

Assuming all goes as planned, private student loan consolidation might have been Trevor’s best choice — only time will tell.

But bear in mind that Trevor’s situation is not typical. The average new graduate earning between $60,000 and $80,000 per year cannot easily afford almost a $2,000-per-month loan payment in addition to taxes and living expenses.

In fact, veterinary graduates with average incomes and average-to-high debt might find that their total payment spread over 20 years in an income-driven repayment plan such as PAYE is less than what they would pay for private consolidation at a lower interest rate. This is true even when factoring in tax on the forgiven balance. (See Navigating student debt, income-based loan repayment for details.)

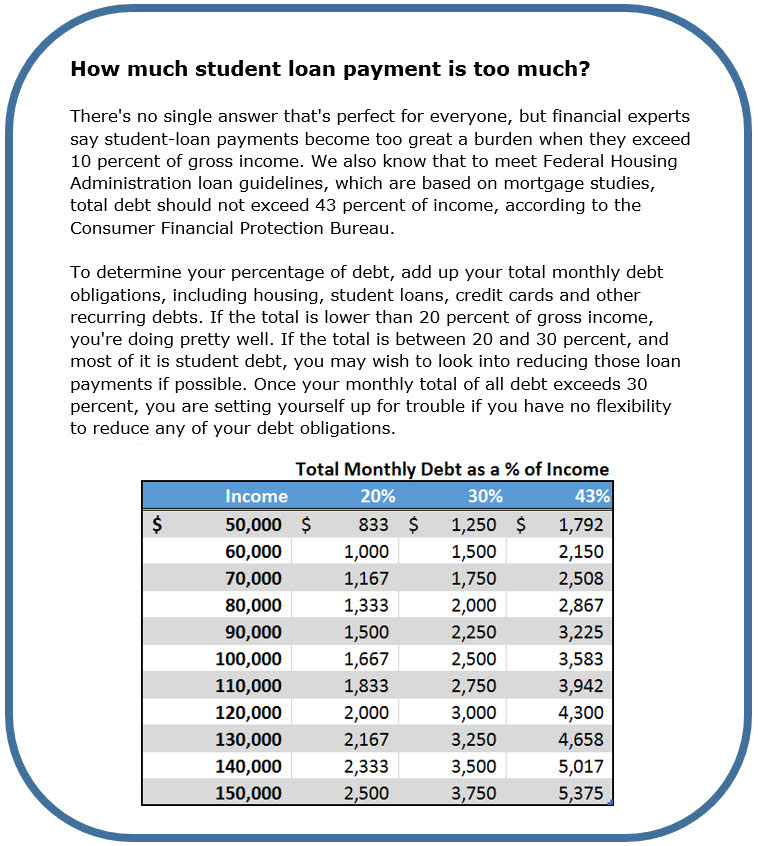

We too often focus only on the interest rates on student loans. If we can only reduce that interest rate, the thinking goes, then we can get these loans off our back. But as we hope we've made clear here, there are multiple factors in your loan-repayment strategy. Minimizing your total loan repayment cost is a major factor. At the same time, while meeting your loan-repayment obligations, make sure you're financially healthy: paying off credit-card debt, starting/building an emergency fund and a retirement fund, perhaps starting a family, buying a house, buying a practice, enjoying life, and being prepared for life's unexpected costs.

So let’s help Trevor try to win a student-debt free future, but be aware that private loan consolidation comes with significant risk. If you're considering it, know which questions to ask, what to compare and the risks you need to consider.

About the authors: Tony Bartels, DVM, MBA, is a 2012 Colorado State University graduate and employee of the Veterinary Information Network. His professional interests include small animal and exotic medicine, advocating for internship quality control and providing guidance on income-driven repayment programs. When he’s not staring holes into his family’s student-loan statements, he enjoys spending time with his wife Audra, a small animal internal medicine specialist practicing in New Jersey. Other family members include two back-alley street mutts named Oakley and Herbie and a tortoise named Leo, who now occupies a rather large territory in Arizona. During his rare instances of free time, you might find Dr. Bartels on the ice between the pipes as a goaltender or fly fishing anywhere travels take him.

Paul D. Pion, DVM, DACVIM (Cardiology), is a board-certified veterinary cardiologist and co-founder of the Veterinary Information Network, an online professional community and parent of the VIN News Service. He earned his veterinary degre from Cornell University in 1983 and completed a residency in cardiology at the University of California, Davis, School of Veterinary Medicine in 1987. Among his many accomplishments, he is credited with discovering the cause, cure and prevention of feline dilated cardiomyopathy secondary to taurine deficiency. Dr. Pion resides in Davis, California, with his wife, children and a plethora of pets.