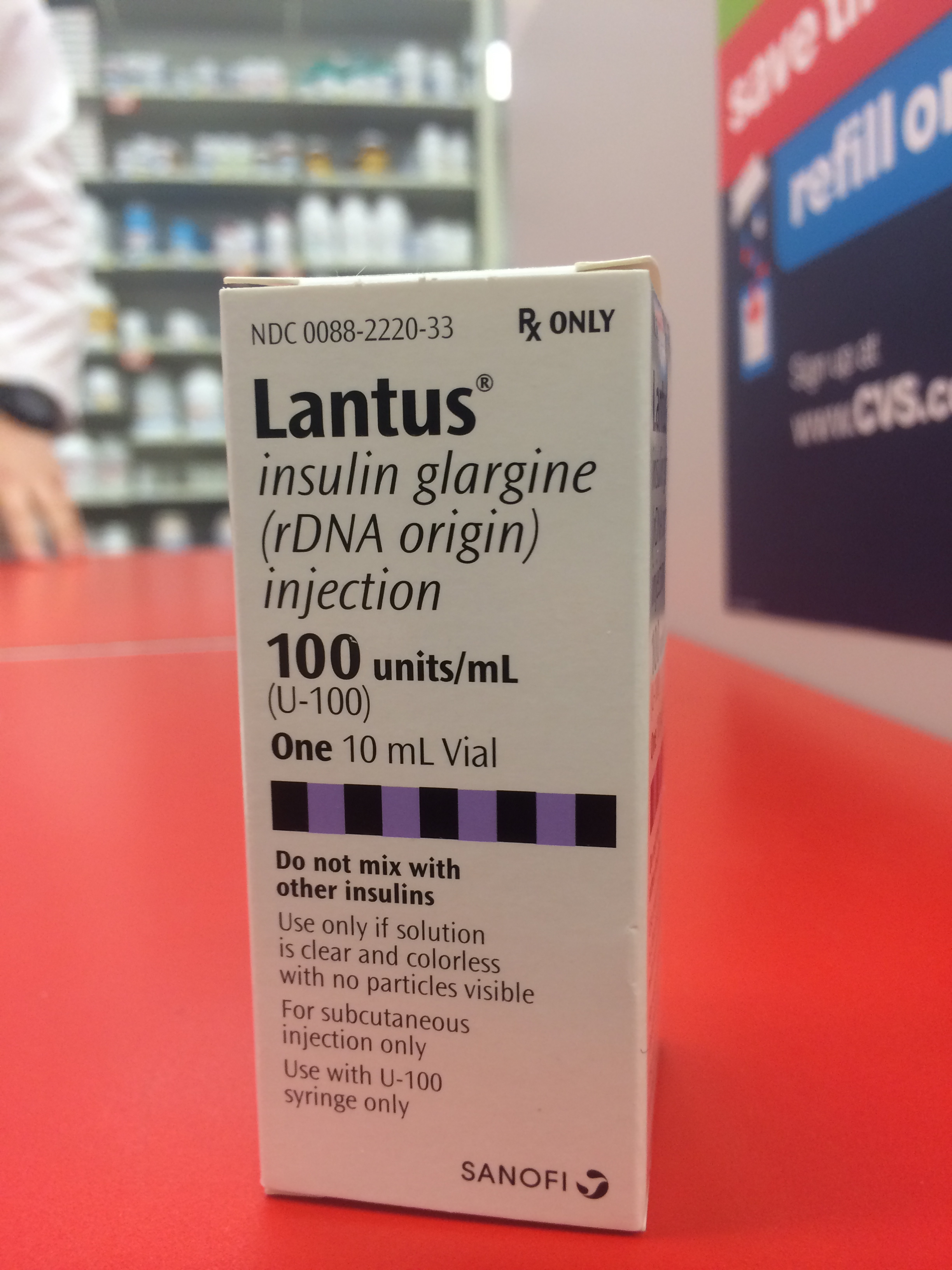

VIN News Service photo

Lantus (insulin glargine) is one of the most commonly prescribed insulins for cats. Drug maker Sanofi has steadily raised its price during the past 12 months, prompting complaints from pet owners and veterinarians.

At more than $200 a 10-ml vial, the world’s most prescribed insulin is priced at or beyond the threshold of what many cat owners are able or willing to pay.

Veterinarians are fielding complaints from clients, leaving some practitioners facing the delicate and time-consuming prospect of re-regulating their feline patients on other insulins.

Dr. Michael Mihlfried, of Athol, Idaho, has prescribed Sanofi's Lantus (insulin glargine) for the past four years. Licensed for use in humans, a 10-ml vial of Lantus holds 1,000 units of the long-acting insulin.

Many veterinarians say it can last a cat owner for months given that a moderate dosage is 2 to 3 units twice daily.

“It’s the insulin I reach for when there's a diabetic cat,” Mihlfried said. “Most of my remissions have come by using Lantus. I have one particular owner who has told me he absolutely can’t afford to use it any longer. The cat is 18 years old. We’re going to try ProZinc."

Manufactured by Boehringer Ingelheim, ProZinc is one of a couple of insulins licensed in the United States for use in cats. It costs about $100 for a 10-ml vial containing 400 units. Vetsulin, manufactured by Merck Animal Health, is another veterinary-specific insulin. It costs around $40 for a 400-unit, 10-ml vial.

How these products compare in price to Lantus can vary depending on the patient. Diabetic cats respond differently to treatments.

Some veterinarians find that Lantus, approved by the U.S. Food and Drug Administration (FDA) for use in humans, works best in their diabetic feline patients.

“All of my diabetics are on it,” said Dr. William Folger, a board-certified feline specialist in Houston. “It was $82 a bottle when it came out, roughly a decade ago. Then it went to $116 and $128. Now it’s being sold at Walgreens for $220.”

Even at that price, Folger believes that Lantus is a reasonable buy for cat owners considering the small size of the dosages — just two to three units, twice daily.

“In general you'll use much less Lantus daily than any other insulin. If it's refrigerated, the potency remains the same, in my experience, for six to even nine months,” he said.

(Lantus' label recommends discarding 28 days after opening, reflecting the expiration date Sanofi submitted to FDA during the drug's approval process. However, many veterinarians report that the insulin has a much longer shelf life.)

Mihlfried said the drug's longevity doesn't solve the problem for his clients, especially those who are on fixed incomes: “Even if you can justify it by saying you can use a single bottle for six or seven months, when you add syringes and monitoring, it’s out of reach for most people.

“People expect price increases from time to time, but this kind of jump. That just makes people angry,” he added.

The cost of Lantus hasn’t reached a tipping point for Folger’s clients given that he practices in one of the wealthiest zip codes in the country. Treating a diabetic cat is expensive apart from the price of insulin, he said, referring to the cost of blood glucose monitoring and frequent veterinary visits.

"Anybody who takes on a diabetic cat is going to spend money to keep the cat going," he said. "There's no cheap way to do it, even if Lantus was free."

For now, he isn’t pushing the switch to a cheaper alternative.

“I don't want to put a cat on one insulin, then have to re-regulate with another insulin,” he said. “In my practice, with four vets and 180 diabetic patients, it's a time-bomb disaster to be regulating all of these diabetics with whatever insulin happens to be the current fad. So 95 percent of my patients are on the same insulin — glargine.

“I tell clients call around before they buy it,” he added.

The VIN News Service surveyed six retail pharmacies in the vicinity of Folger's practice. Prices for a 10-ml vial of Lantus varied by as much as $57, roughly 28 percent.

Asked what’s driving the price increases, officials with Sanofi US responded that the company “considers a wide variety of market conditions in the United States in determining price.”

“We consider if it is a newly launched product or nearing its patent expiration,” the company explained by email. “We look at the competition, the presence of other branded products on the market that might compete with our product and how these products are priced. We also take into account the presence of generic products, which might result in lower prices for all products within a given therapeutic class.”

Industry media paint a more detailed picture about what’s pushing Lantus prices. For starters, patients in the United States purchased fewer drugs last year, alleviating pressure from health insurance companies to keep pharmaceutical price increases at a minimum.

Various news reports also point out that the patent protection on Sanofi’s blockbuster drug expires in 2015, opening the generics market to competitors.

Merck & Co. announced Feb. 10 that its version of glargine soon will enter late-stage clinical trials, and the company is partnering with Samsung Bioepis on the project. Eli Lilly also has a generic equivalent in the works.

Sanofi responded last month by suing Eli Lilly for alleged patent infringement. The lawsuit triggered an automatic 30-month stay of approval by the FDA, delaying the release of Eli Lilly’s generic to mid-2016.

Industry experts believe Sanofi also will sue Merck. Last month, Citigroup financial analysts wrote that any delay would provide Sanofi “increased pricing power” in the $6-billion U.S. basal insulin market.

Stalling the release of generics also gives Sanofi time to finish developing a new version of Lantus called U300 before cheaper alternatives hit the market. The company is expected to seek regulatory approval in the United States this year, according to industry news reports.

Folger reflects on such tactics with disdain: “Glargine is soon to be manufactured as a generic, which should make it cheaper. But the recent increase in the cost of this insulin is a perfectly reptilian business tactic by the manufacturer to squeeze all the possible profit before the generic becomes available."

It's "American commerce in action,” he said.

Editor's note: Sanofi's Lantus Savings Card program offers discounts on Lantus SoloSTAR pens. Each pen contains 3-ml of insuline glargine. To order, a prescription must be written for Lantus SoloSTAR pens rather than a 10-ml vial.